Review: TurboTax W-4 Paycheck Withholding Estimator 2025 - 2026

Employees

can use this Withholdings Calculator to help them determine whether they should give their

employer a new Form W-4,

Employee's Withholding Allowance Certificate to correct having too much or too little

federal income taxes withheld from their paycheck.

Employees

can use this Withholdings Calculator to help them determine whether they should give their

employer a new Form W-4,

Employee's Withholding Allowance Certificate to correct having too much or too little

federal income taxes withheld from their paycheck.

With the results from the TurboTax Withholding Calculator you can fill out a new W-4, Employee's Withholding Allowance Certificate form to submit to your employer and change the amount of taxes being withheld from your pay.

Who Should Use The Withholding Calculator?

- Employees wishing to reduce their end-of-year tax refund or tax due balance.

- Employees with approximated job situations per paper

W-4 worksheets

- Tax filers with concurrent jobs

- Couples that are both employed

- Head of Household tax filers

- Taxpayers with several children eligible for the Child Tax Credit

- Employees with non-wage income in excess of their adjustments and deductions, that prefer to have additional tax withheld from their paychecks instead of making periodic separate payments through the estimated tax procedures.

The United States federal government requires employers to withhold taxes on employee wages, as do most state and some local governments. Taxes that are required to be withheld include:

- Federal: Employee Income Taxes

- State: Employee Income Taxes

- Federal Social Security Taxes

- Federal Medicare Taxes

- Other local and state taxes or levies.

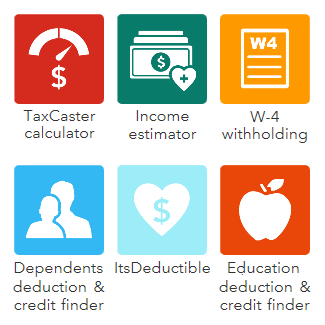

Here is our Review on How to Use the TurboTax W-4 Employee Paycheck Withholding Estimator

With the TurboTax W-4 Estimator you can estimate the amount of taxes that should be deducted from your paycheck. By using the TurboTax W-4 Withholding Calculator you avoid paying in too much in taxes or avoid underpaying taxes which could result in penalties.

More take home pay per paycheck? or bigger tax refund? TurboTax makes it easy to determine how much withholding allowance you should take to come out even at year end with Uncle Sam.

Different factors come into play when calculating your w-4 employee paycheck withholding including: you personal information, your paychecks, other income, your home mortgage and taxes, qualified donations and charitable contributions you make, retirement plan investments, and continuing education expenses.

Getting Started With TurboTax W-4 Withholding Estimator

Start by gathering your previous year's income tax return as well as your most recent paycheck or paycheck stub.

Once you have gathered these items you can start using the TurboTax W-4 Calculator by answering "personal info" questions including:

- Your head of household and marital status

- Your age on December 31st of the year w-4 calculations are for

- How many dependants and child care recipients you have

- The amount of alimony and child care expenses you pay

In the next step you enter "your paycheck" information including:

- How often your paid and date you receive your next paycheck

- What your current federal withholding allowance is

- Your current W-4 filing status, (single, married, etc.)

- Your taxable income amount per pay period

- Total state tax withholding expected for the current year

- Current years income received and amount of taxes paid

- Any other federal or state tax payments that have been made

In the next step you will enter your "other income" including: Long and Short Term Gains or Losses, IRA or Pension Distribution Payments Received, Interest Earned, Dividends Received, Social Security Benefit Payments, Alimony, and other Misc. Income.

Now you move on to your "homeowner deductions" including mortgage interest and real estate taxes paid.

Once that information is entered you will enter any "qualified charitable contributions and donations" you have made.

In the next step you will enter any "qualified retirement account contributions" you have made including Traditional and Roth IRS's.

Now you will enter your "deductable education costs" including any tuition fees or student loan interest you are paying.

Once

you get this far you have reached the "results page" where you can see how changes

to your w-4 withholding will influence your tax refund and take-home pay as your paycheck

withholding is adjusted.

Once

you get this far you have reached the "results page" where you can see how changes

to your w-4 withholding will influence your tax refund and take-home pay as your paycheck

withholding is adjusted.

You can do this by sliding the withholding allowance bar to change the number of withholding allowances that you are using to determine the proper amount of taxes that should be deducted from your paychecks.

Your withholding allowance is used by your employer to calculate the proper amount of income tax withheld from your paychecks so that you end up paying close to the actual amount of annual taxes that will be owed by year end. That's it, Your Done! Easy Right? :)