Estimate Tax Refund 2024 - 2025

Here we are with another tax year coming to an end and another tax season is upon us. This is the time of year when you may feel a significant weight on your back if your sitting around wondering what your financial situation may be with the tax man. That's right, you may feel like Uncle Sam is out to get you...

I'm

not one to let this time of year get to me based on worrying what my income tax liability

may be. Instead, I estimate my tax refund status several times a year. This helps me keep

in tune with my income tax statistics all year long so that I am comfortable knowing I have

no surprises coming, like "a big tax bill" that I may not be prepared for.

I'm

not one to let this time of year get to me based on worrying what my income tax liability

may be. Instead, I estimate my tax refund status several times a year. This helps me keep

in tune with my income tax statistics all year long so that I am comfortable knowing I have

no surprises coming, like "a big tax bill" that I may not be prepared for.

You'll be surprised, or more accurately shocked if you find out you have a big tax bill you were not expecting, but that shock is a lot easier to avoid than you think.

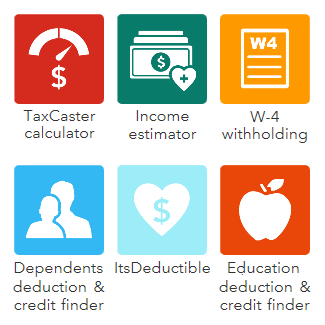

We offer a guide here to the TurboTax TaxCaster as well as our simple tax calculator that you can use anytime you want to estimate your tax refund, or taxes owed based on projected income.

Simple Tax Calculator - TurboTax TaxCaster Review Below

Using our Income Tax Estimator is quick and easy, but, it is not as comprehensive as you may like it to be since only federal income tax liability is taken into consideration. Other taxes that play a roll in your final balance with the Internal Revenue Service (IRS) include Social Security Taxes and Medicare Taxes.

To get a more accurate reading on your full obligations I recommend you use the TurboTax TaxCaster App or Online Tax Calculator.

These options are free as well but I prefer the app since I have it installed on my iphone and it saves my entries so that all I have to do is go back and make adjustments when needed based on financial changes I may experience throughout the year.

How to Estimate Tax Refunds with the TurboTax TaxCaster App

TurboTax offer a Tax Calculator App called TaxCaster that you can download online from their website. This is the same tax calculator that they offer for use online for free.

The nice thing about the TurboTax TaxCaster App is that after downloading it to your Android or iPhone, it saves the data you enter so that all you have to do is make adjustments throughout the year when you have financial changes in your life and income. This way your always aware of where you will be financially at year end with Uncle Sam looking over your shoulder.

Personally, I keep this app programmed on my iphone all year long so that as my income changes or additional adjustments need to be added like charitable donations, or non taxable IRA retirement investments, I can make those adjustments in seconds and see how the effect my taxes.

So How Easy Is The TurboTax TaxCaster App to Use?

Honestly, I cant tell you the answer to that question because you wont believe me. Ok, Ok, I'll try anyway. It's so EASY, even a cave man could do it! I know, corny right... But, It really is that easy!

You start with the "About You" page where you enter your marital status, your age, and your dependants and child care information.

Next is "Your Income" page where you will enter Your Income and Taxes Withheld. If you have your own business you will enter your income under business income and still enter any quarterly tax payments you have made under taxes withheld.

Remember, you can go back at anytime and make changes to any figures you have already entered.

The Turbo Tax TaxCaster App works just like the TurboTax Online TaxCaster tool but I found that downloading the TurboTax app to an iPhone or Android smart phone keeps it accessible anytime I want to take a look at my financial standings, or make adjustments.

Now on "Your Tax Breaks" page is where you want to enter any tax deductions you should be claiming to help lower your tax bill.

The tax deductions can include: Charitable Donations or Contributions, IRA Retirement Contributions, Education Expenses, Home Mortgage Interest and Paid Real Estate Taxes, plus any other qualifying deductions that can help you keep more of your hard earned dollars instead of the IRS.

You can use this TurboTax TaxCaster to estimate what your employee w-4 paycheck withholding should be based on what your tax amount owed at year end is calculated at.

This allows you to make adjustments to insure your not paying in too much or worse, not paying in enough which could result in penalties.

Now that you have entered your information into the TaxCaster TurboTax Tax Calculator you can go to the "Final Result" page to see how it all plays out.

calculations complete, you will be ready anytime you make the effort to prepare your tax return and file your taxes for the year.

I don't like financial surprises telling me that I owe more money when April 15th rolls around, and this calculator helps me avoid that. It also help me make sure that I am not giving the Uncle Sam an interest free loan by paying in too much in quarterly payments.

Our review was easy and fun as it revealed that the TurboTax TaxCaster is a very useful tool that can keep taxpayers stay informed about their income tax obligations and liabilities all year long.

Try it, I have no doubt you will like it!